Welcome to the world of unlevered, illiquid, venture investing!

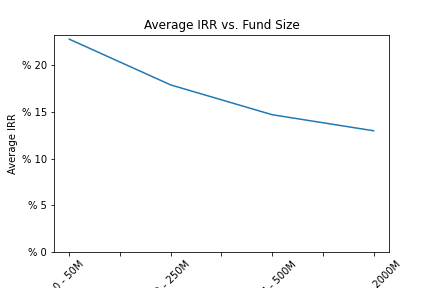

In this bizarro world, bigger is worse, and investors don’t seem to care.

What is going on?

Part One of a Three Part Series

Venture Capital Returns by Fund Size: Comparing Early-Stage vs. Later-Stage

Venture capital (VC) is a critical component of the financial landscape, fueling innovation and growth within the startup ecosystem. However, the returns on venture capital investments can vary significantly based on several factors, including the stage of investment and the size of the fund. Without trying to boil the ocean, I’m going to do a quick look at how venture capital returns diverge by fund size, with a specific focus on comparing early-stage and later-stage VC investments. Additionally, I want to cover how early-stage funds, particularly those smaller than $250 million, often outperform their larger counterparts, especially when compared against broader market benchmarks like the S&P 500.

Venture capital funds are typically classified into different stages based on the maturity and revenue of the companies they invest in: early-stage (Seed and Series A), mid-stage (Series B and C), and later-stage (pre-IPO financing). The size of these funds can also vary, ranging from small funds (less than $250 million) to large funds (more than $1 billion).

Later-Stage VC: Higher Risk with Lower Relative Returns Relative to Early Stage VC

Later-stage venture investments involve funding more established companies that are closer to a public offering or a major liquidity event. These investments are perceived as less risky compared to early-stage investments because the companies have proven business models and steady revenue streams. However, the return on later-stage investments can be less attractive compared to early-stage investments on a risk-adjusted basis. According to data from Cambridge Associates, later-stage VC funds have demonstrated lower returns compared to early-stage funds. The 10-year pooled return for later-stage funds as of 2020 was around 12%, significantly lower than the returns generated from early-stage funds which averaged around 20% (1). I’m looking for more recent data, because I’d bet my bacon that late stage fund returns went down, a lot, on average. At least, that’s what institutional LPs tell me, a lot. So much so, I wonder why they keep investing (that is part II of this essay).

Moreover, when comparing these returns to the S&P 500, which delivered a historical average annual return of approximately 8% to 10% with considerable liquidity, the attractiveness of later-stage VC diminishes further. The lack of liquidity and higher relative risk associated with late-stage venture investments, combined with returns that do not commensurately reward this increased risk profile, makes them less appealing compared to other investment opportunities. And yet, late stage VC keeps on raising money, lots and lots of money.

Early-stage venture capital involves investing in startups at their nascent stages, typically while their revenues are $3mm a year or less. These investments are inherently riskier due to the unproven nature of the businesses and their higher likelihood of failure. However, the potential for high returns is significant, especially for top-performing funds. A pivotal study by Cambridge Associates shows that top decile early-stage venture capital funds, particularly those with under $250 million in assets, have significantly outperformed their larger counterparts and broader market indices. The top decile of early-stage funds reported returns as high as 35%, showcasing exceptional performance that should attract sophisticated investors (2).

This performance variance can be attributed to several factors. Smaller early-stage funds are often more agile, able to make quick decisions, and invest in innovative startups that larger funds might overlook. Additionally, these smaller funds can provide more hands-on support to their portfolio companies, contributing to their chances of success.

That’s where early-stage VCs can generate massive alpha, and late stage simply can not because the companies are already significantly de-risked. Risk equals reward, and those who manage risk better, can earn returns in excess of their risk adjusted expectation. Later stage VCs require less risk-management ability, and their relatively poor returns reflect this.

Comparative Analysis with the S&P 500

When compared to the S&P 500, top-performing early-stage venture capital funds offer much higher returns, albeit with greater volatility and liquidity risk. For investors, this trade-off is often acceptable due to the substantial premiums involved. According to the National Venture Capital Association, early-stage funds not only surpass the S&P 500 in terms of returns but also contribute significantly to job creation and technological advancements, thereby offering both financial and societal benefits (3).

Part II Teaser

In summary, while venture capital as an asset class can offer high returns, the variability of these returns based on the stage of investment and the size of the fund is significant. Later-stage venture capital, despite its lower risk profile relative to early-stage investments, often fails to provide returns that justify the risks and illiquidity involved. Conversely, smaller early-stage funds, particularly those making Seed and Series A investments, consistently outperform not only their later-stage counterparts but also the broader market indices like the S&P 500 when considering top decile performers. These findings underscore the importance of strategic fund selection based on detailed performance data and fund characteristics in the venture capital industry.

So how did we get here? Why are LPs piling into bigger and bigger funds that offer returns lower, and lower each year? This makes even less sense when we consider that the S&P has been recently beating late stage VC returns, WITH LIQUIDITY!!!

【1】Cambridge Associates, US Venture Capital Index and Selected Benchmark Statistics

【2】Cambridge Associates, US Venture Capital Index

【3】National Venture Capital Association, 2020 Yearbook